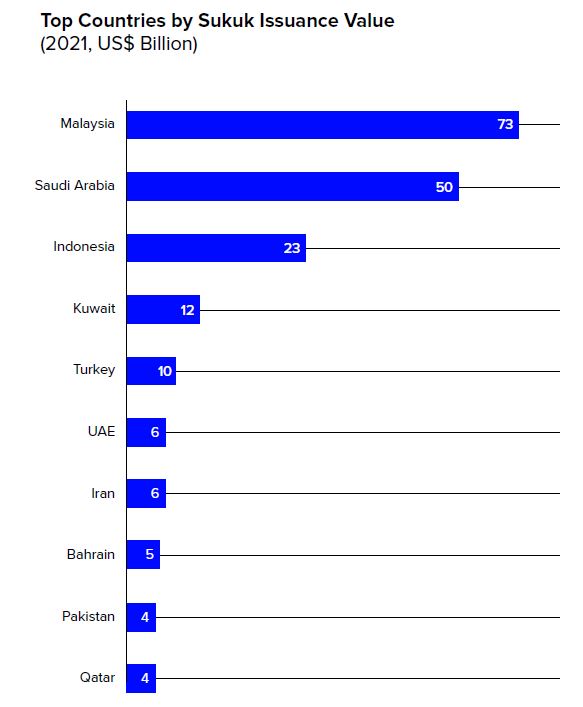

Saudi Arabia is the second largest Sukuk issuer globally

The popularity of Saudi Arabia sukuk is relatively new compared to Malaysia and UAE. Sukuk issuance in Saudi market started with infrequent issuances in the middle of the 2000s. A single sukuk issuance was performed in 2004 by HANCO Rent-A Car.

The next sukuk issuance took place in 2006 by Saudi Arabian Basic Industries Corporation (SABIC). The issuance of SABIC sukuk generated tremendous attention as it received SAR 4.3 billion in order, overshooting the SAR 3 billion (US$ 800m) cap set by the CMA. The second in the same year was by Saudi Electricity Company which made headlines by issuing sukuk worth SAR 5 billion (US$ 1.33 billion) in July 2006, the largest ever by a Saudi corporation.

In August 2006, with the first listing of SABIC sukuk, an over-the-counter market was launched. Under this system, trades are negotiated off the exchange and there is no system to match buy and sell orders; most trades were done through the treasury departments of local banks. Due to the lack of depth of the market, lack of transparency and the lack of historical trade information, the sukuk was, however, very thinly traded.

The sukuk market in KSA saw some turmoil in 2008 following the global financial crisis. Consequently, sukuk issuance in KSA declined 67.2% YoY to US$ 1.9 billion in 2008 before again increasing to US$ 3.1 billion in 2009.

It was worth noticing that the majority of the sukuk issuances in Saudi Arabia are denominated in Riyal. In contrast, less than half of the sukuk were denominated in local currency in other GCC countries during the same period. UAE, leading both sukuk and conventional bond issuance within GCC, represented about half of the total debt issuance in both 2007 and 2008. Saudi Arabia accounts for about 23% and 12% of the total GCC debt issuance in 2007 and 2008, respectively.

The First Sovereign Sukuk of Saudi Arabia

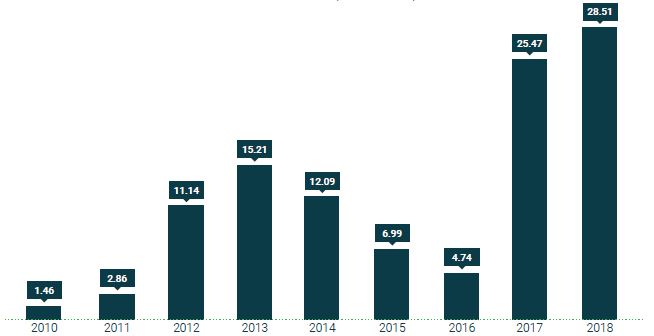

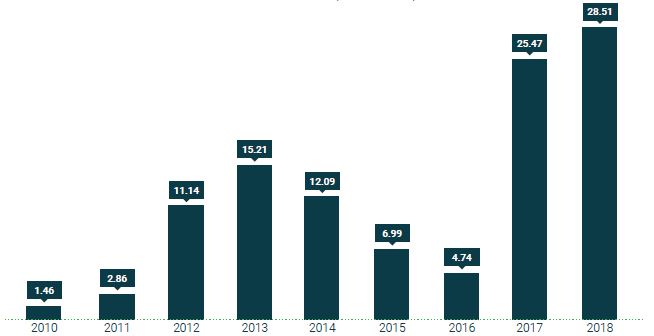

The General Authority for Civil Aviation (GCA) in January 2012 issued sukuk worth SAR 15 billion (US $4 billion), which was Saudi Arabia’s first and largest government-backed sukuk at that time. In the year of 2012 alone, total sukuk worth US$ 11.14 billion was issued in Saudi Arabia. Such a huge amount of sukuk issuance was not intended to merely raise money; rather it was meant to stimulate the market that would hopefully benefit banks endowed with a massive amount of unused liquidity. Indeed, it was also beneficial in restoring the market confidence among the market players. In tandem with sukuk market expansion globally, 2013 marks another flourishing year for sukuk issuance in Saudi Arabia with the total issuances of US$ 15.21 billion.

In 2014, Saudi Arabia became the second largest issuer of sukuk by issuing a total of 15 issuances with a total value of US$ 12.1 billion. In addition, the Saudi Capital Market Authority simplified regulatory approvals for sukuk products, which also garnered the sukuk market in Saudi Arabia.

Pushing the Market to a New Level

The year 2017 marks a significant milestone for Saudi Arabia. It embarked on issuing international sukuk worth US $9 billion on 12 April 2017, pushing the market to a new level. This issuance was not only the first dollar-denominated sukuk among the GCC member countries, but it was also the largest debt instrument issuance in emerging markets to date, surpassing Kuwait’s US $8 billion conventional bond issuance in March 2017.

Sukuk Structure in KSA

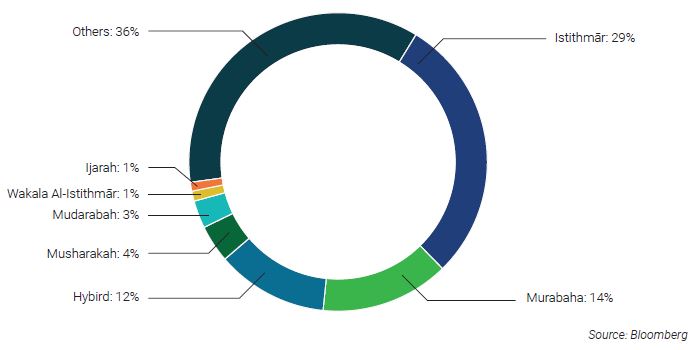

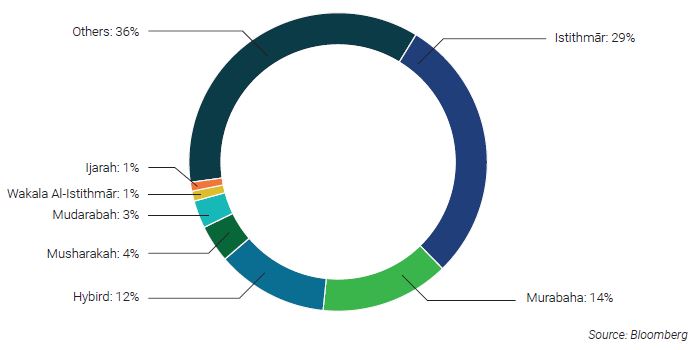

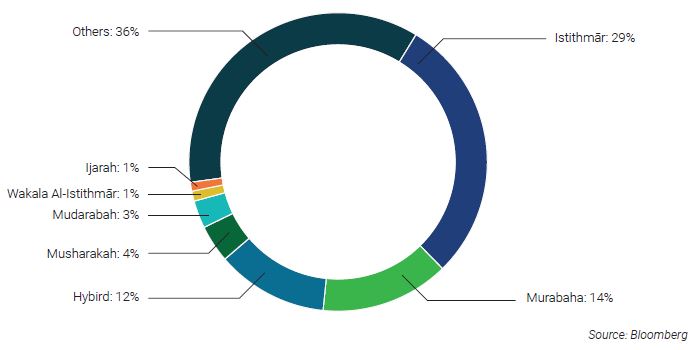

Different structures have been used over the years, with istithmār and murābaḥah being the most prominent, accounting for slightly over 30% of sukuk issued so far (Figure 3.12). Prior to 2011, istithmār sukuk was the most popular structure among the issuers. Although the number of corporate sukuk issued has exceeded that of sovereign sukuk in the recent years, the cumulative issuance amount of sovereign sukuk is greater than that of corporate sukuk.

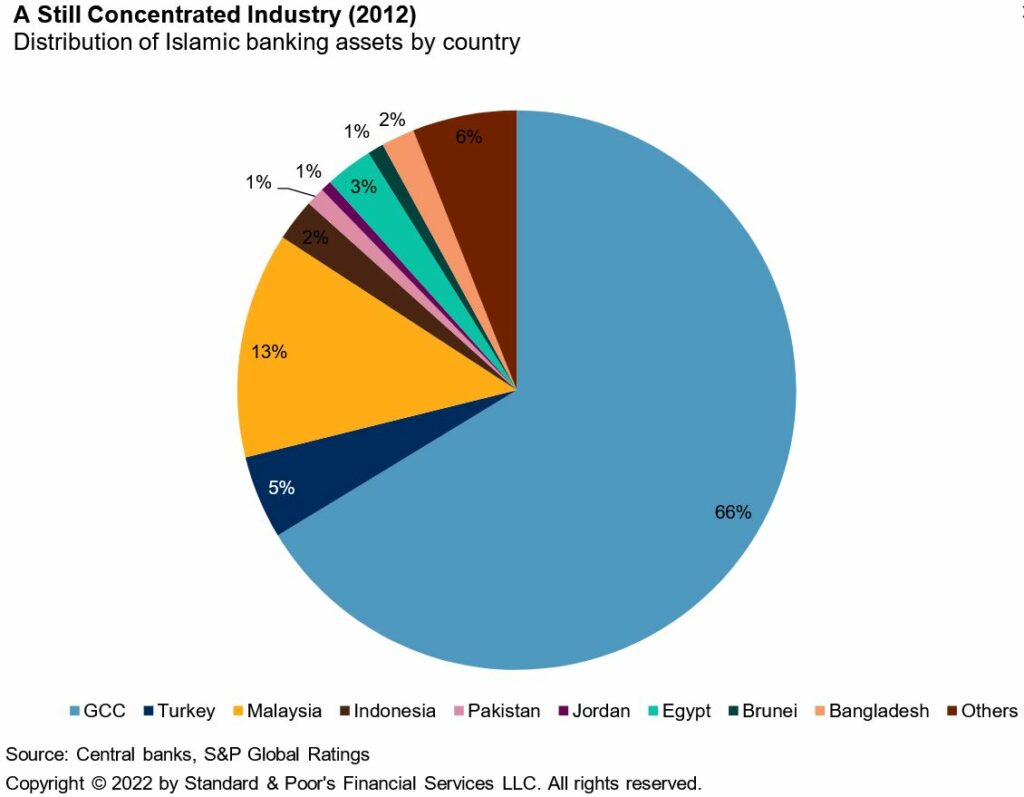

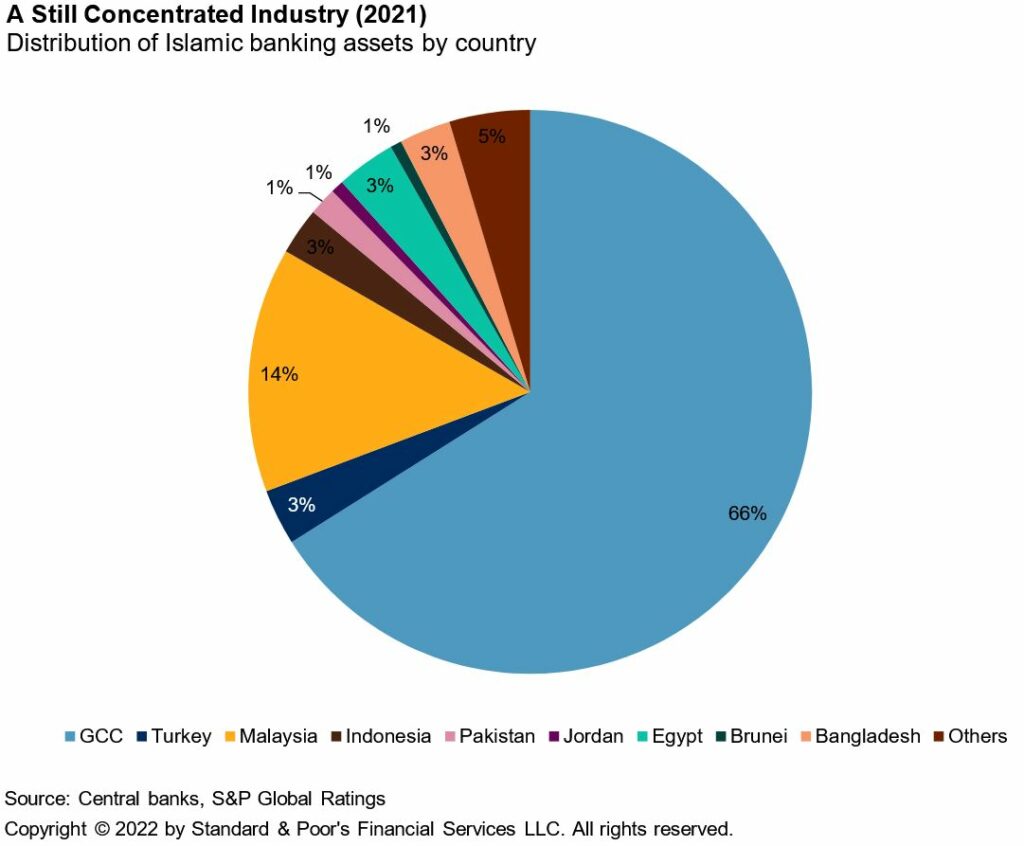

Saudi Arabia is the Second Largest Sukuk Issuer Globally

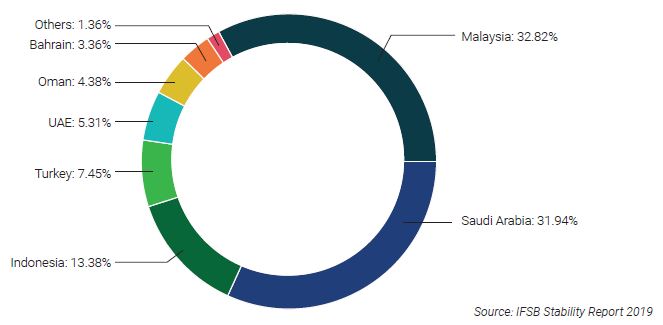

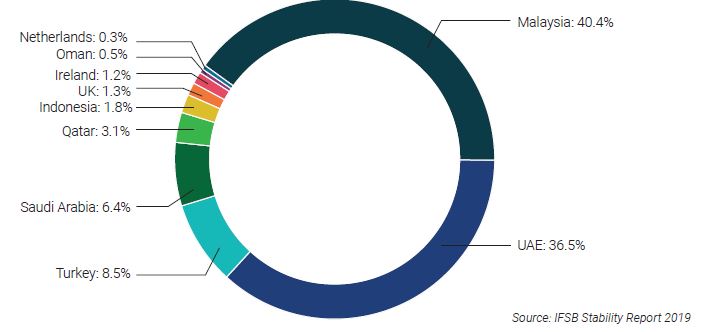

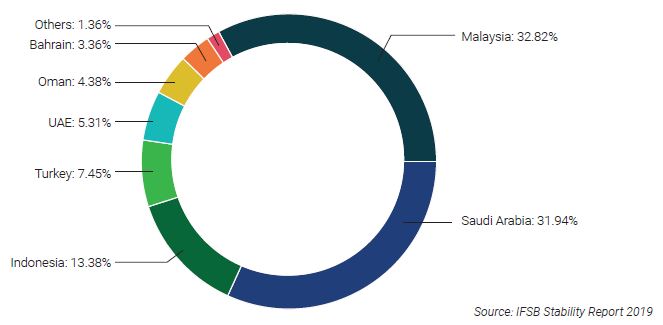

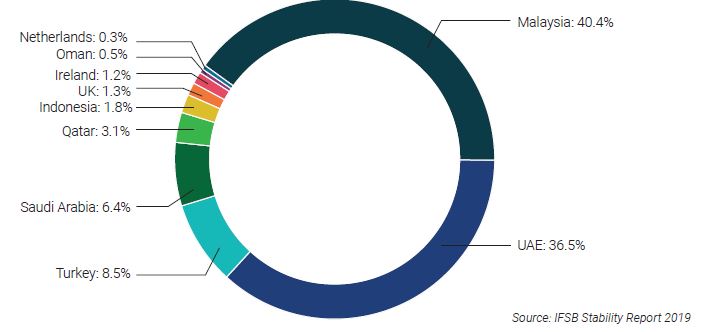

According to IFSB (2019), while Malaysia retained its position as the overall largest issuer of sukuk in terms of volume, Saudi Arabia is the second-largest overall issuer. UAE is the third-largest issuer due to its increase in corporate issuances, while Indonesia is on the fourth rank. Turkey is the fifth-largest issuer due to the increased activity in 2018. In terms of the type of sukuk, the sovereign issuances prevailed in Saudi Arabia in 2018 as it was in previous years.

Source: ISLAMIC FINANCE IN SAUDI ARABIA: Leading the Way to Vision 2030. Islamic Development Bank