RHB Weekly: Silence Broken in Sukuk Space

today

30 October 2015 GMT

Commentary by RHB Global Sukuk Markets Research, Kuala Lumpur, Malaysia

Indices ended almost flat at -0.04% to 0.06% and 0.8bps wider yields last week.

The Bloomberg Malaysia Sukuk Ex-MYR Total Return (BMSXMTR) and Dow Jones Sukuk Total Return (DJSUKTXR) indexes closed the week at 102.4 (-0.04% w-o-w) and 156.4 (+0.06% w-o-w) respectively. Saudi, Qatar and Turkish bank credits garneréd the most interest with names such as IDB Trust Services 19 (Aaa/NR/AAA), Qatar 18-23 (Aa2/AA/NR), KT Kira Sert Varlik 19 (NR/NR/BBB) and TF Varlik Kiralama AS 19 (NR/NR/BBB) trading higher as market capitalization gained by USD13.2m. Weighted average yield was 0.8bps w-o-w wider at 2.23% after six weeks in a row of tightening, following Moody’s projections of a cut in Brent oil prices to USD53/barrel in 2016 (from USD65/barrel) and USD60/barrel in 2017 (from USD80/barrel) while Chinese 3QGDP and Japanese Sept exports slowing to 6.9% (vs. 2Q15: 7.0%) and 0.6% y-o-y (vs. prior: 3.1%) respectively.

Turkey’s CDS improved further on easing sentiments over upcoming election.

The spread has fallen 15.2bps to 253.6bps as political tensions are expected to subside after November election, despite central government balance turning into a deficit from +TRY5.2bn to -TRY14.1bn. Similarly, CDS for Bahrain, Abu Dhabi and Qatar tightened by 2.5bps-5.8bps to 308.5bps, 71.9bps and 70.9bps respectively. An opposite trend was observed over the week for Indonesia (+1.9bps to 215.4bps), Dubai (+2.4bps to 195.9bps), Malaysia (+4.7bps to 204.7bps) and Saudi Arabia (+6.6bps to 134.5bps).

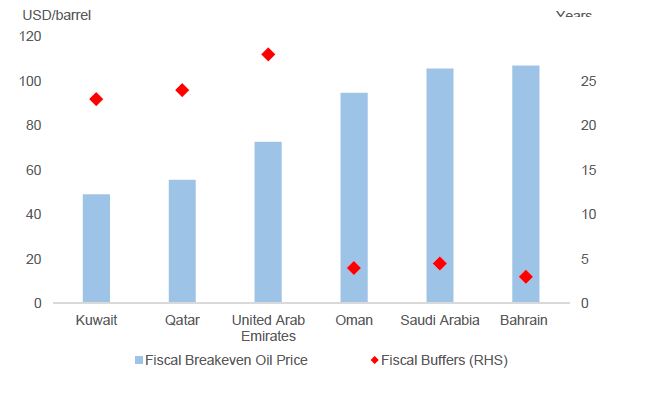

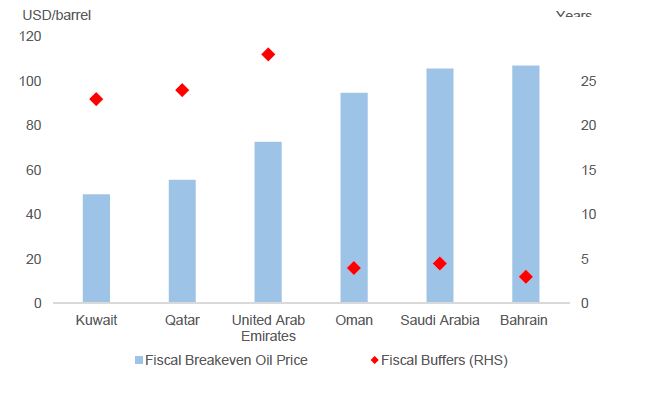

Uneven fiscal strengths in GCC region suggest varied borrowing capacity.

The decline in crude oil prices has weakened the fiscal positions of GCC states. Despite the mounting pressure to implement subsidy reforms, budget spending remain broadly unchanged at c.44% of GDP as GCC states accelerated economic diversification from oil. Without such structural changes, the economic prospect of the region may remain at threat given an unlikely recovery in crude oil prices, at least in the near term. Nonetheless, multiyear expansionary policies might not be sustainable as fiscal buffers have been significantly weakened, mainly due to lower oil revenues.

Measured by the years of fiscal buffers and fiscal breakeven oil prices (refer to Chart of the Week), Oman (A1/A-/NR) and Bahrain (Baa3/BBB-/BBB-) seem vulnerable to prolonged expansionary policies and would exhaust their buffers in less than five years, building up pressures on their banks with notably reduced deposits inflows and increased borrowings by governments and government related entities. Saudi Arabia (Aa3/AA-/AA), on the other hand, has low government debt (1.6% of GDP) and sizeable reserves of USD726.8bn in 2014, allowing more room for debt issuance at the event of any budgetary shortfalls. Sovereign credit profile for Kuwait (Aa2/AA/AA) remains the most resilient, followed by Qatar (Aa2/NR/NR) and UAE (Aa2/NR/NR).

Chart of the Week: Uneven fiscal strengths in GCC region.

Sustainable and Responsible Investments (SRI) Sukuk tax incentives and extension of double deduction for retail Sukuk announced in Malaysian 2016 Budget.

In the 2nd Measure of the First Priority of the 2016 Budget, to further invigorate the capital market, the government announced a tax deduction on issuance costs of SRI Sukuk as of 2016. Currently, tax incentives are given on Sukuk issuances of Mudharabah, Musyarakah, Ijarah, Istisna’, Murabahah, Wakalah and Bai Bithaman Ajil from year of assessment 2003 to 2015, while Ijarah and Wakalah structures have been extended for another three years from 2016 to 2018. The SRI tax incentive is proposed for five years (2016 – 2020) on Sukuk issuance costs, given that it is approved by the Securities Commission (SC). In addition to the SRI Sukuk tax incentive, the government also announced the extension of double deduction or further deduction of retail Sukuk for another three years (2016-2018) in order to encourage more investors’ involvement in the capital market. The additional costs include professional fees relating to due diligence, drafting and preparation of prospectus, printing cost of prospectus, advertisement cost of prospectus, SC prospectus fees, Bursa Malaysia processing fee and initial fee as well as Bursa Malaysia new issue crediting fee, and primary distribution fee. These deductions are included on additional issuance costs of Sukuk under Mudharaba, Musyarakah, Istisna’, Murabahah and Bai’ Bithaman Ajil based on Tawaruq, and further deduction on additional issuance costs of Sukuk under the principles of Ijarah and Wakalah.

Incentives will consolidate Malaysia’s position in the Sukuk market

Malaysia is already the largest Sukuk market accounting for about 60% of the global Sukuk market. Khazanah issued its first tranche of MYR100m of its MYR1bn SRI Sukuk in May this year, which raised funds for its Trust schools programme where proceeds of the Sukuk will be channeled to Yayasan AMIR. Nevertheless, we may see weaker demand for SRI Sukuk if compared to corporate or sovereign issuances, as investors would have to accept lower yields; to recap, Khazanah’s SRI Sukuk issuance attracted c.1.3 times demand, lower compared to other Sukuk.